No matter the size of your company, bringing on new clients is an ongoing process. While new business is always beneficial, the profits of onboarding new customers significantly decreases the more you spend on acquisition.

No matter the size of your company, bringing on new clients is an ongoing process. While new business is always beneficial, the profits of onboarding new customers significantly decreases the more you spend on acquisition.

According to KISSmetrics, companies focus more on acquisition more than customer retention – although the former can cost 7X more than the latter. But both are important. And despite how low retention cost can generally be, you shouldn’t rely on current customers for the bulk of your revenue.

Before you can begin lowering your customer acquisition cost, you’ll first need to learn how to measure it:

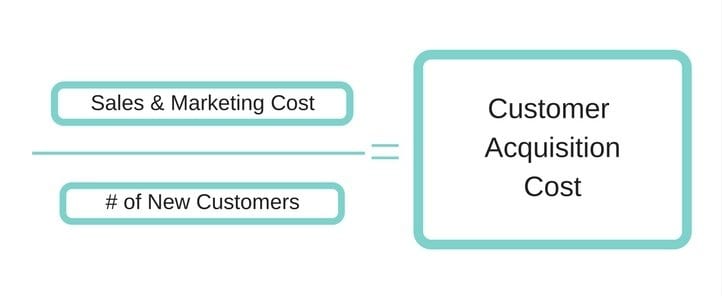

Customer Acquisition Cost Formula

To determine your customer acquisition cost, keep the measurement simple.

Add up your total sales and marketing spend (over a given period) and divide by the total number of new customers generated at that time.

For example, in 2016 Bob’s B2B Business had a total marketing cost of $100,000 and a total sales cost of $100,000. He generated 10,000 new customers in that year. As a result, Bob had a customer acquisition cost of $20 in 2016.

In summary: CAC = (total marketing costs + total sales costs) / total customers acquired.

Keep in mind that this formula isn’t the only way to determine acquisition costs for your business.

In fact, your CAC can be measured by a variety of elements depending on your industry. For example, companies in your industry might measure by campaigns, creating an overall cost that reflects the contribution of each so you can better understand where to focus marketing efforts.

The final factor to consider? The relationship between CAC and lifetime value. While important, customer acquisition cost doesn’t mean much on its own. That’s where lifetime value (or LTV) comes into play. LTV helps you put context around your customer acquisition cost, so you’re better equipped to decide how much you need to lower it.

The ideal relationship results in an LTV that’s at least 3X your CAC. And if you fail to meet that, revisit the model and follow David Skok’s advice – “look for ways to a) raise your prices and/or b) reduce your costs.”

The Lowdown

Once you’ve accurately measured your customer acquisition costs (by following industry best practices), you can begin to execute a plan to improve and lower it! Here are four tips to get you started:

1. Focus your buyer personas

The right personas can do a lot for your business, ultimately enabling you to focus your time and resources in the best way possible instead of wasting your energies on trying to market to the wrong audience.

It’s a no-brainer, but when you’ve found the right channels and message for your ideal customer, costs will decrease.

2. Go “all in” with SEO

This isn’t a rallying cry for you to start up a paid search campaign to lower your customer acquisition costs, but SEO does matter. When you create primary long tail keywords based on your buyer personas and optimize content around those keywords, you can keep bringing in qualified leads time over time without putting in any extra spend.

3. Implement marketing automation

You can slash costs when you use marketing automation to support your efforts. The best automation platforms are full-funnel solutions that cut down on the hours your team spends collecting and organizing data, segmenting contacts, scheduling emails, building CTAs… you get the picture.

A Gartner study revealed organizations that automate lead management see a 10% (or greater) revenue increase in six to nine months. When your revenue increases, your CAC will naturally decrease.

4. Develop a lead nurturing strategy

The best way to turn prospects from strangers into leads is with email. Not only is email an affordable channel (it costs next to nothing to send an email, apart from the overhead costs for your team to build and schedule it), lead nurturing can generate more sales-ready leads. A shorter sales cycle will usually lower your acquisition costs.

What Else Can You Do to Lower CAC?

The tips provided in this article are by no means an exhaustive list of solutions to lower your customer acquisition cost. Companies can also conduct extensive A/B testing, invest in technologies that help with a better understanding of data and analytics, and so much more.

While there are many different tactics you can employ, remember to properly calculate your CAC first. From there, you’ll be ready to start lowering your customer acquisition cost.

Editor’s Note: This post was originally published in January 2017 and has been updated for clarity and accuracy.