Proving the value of your marketing efforts can be a difficult feat, but it’s not an impossible one. If your boss isn’t convinced that marketing is worthwhile for business growth, you’ll want to gather plenty of data to showcase just how profitable your campaigns have been.

Proving the value of your marketing efforts can be a difficult feat, but it’s not an impossible one. If your boss isn’t convinced that marketing is worthwhile for business growth, you’ll want to gather plenty of data to showcase just how profitable your campaigns have been.

Calculating the return on investment of your marketing lies in six key metrics:

- Customer Acquisition Cost (CAC): The average total cost you spend on acquiring a new customer.

- Marketing % of CAC: The amount of your marketing budget that goes towards acquiring new customers.

- Ratio of Customer Lifetime Value to CAC: How much revenue a new customer brings in compared to how much you spent to acquire them.

- Time to Payback CAC: How many months it will take to earn back the money your company spent on acquiring a new customer.

- Marketing Originated Customer %: How many new customers are derived as a result of your marketing.

- Marketing Influenced Customer %: How many newly acquired customers your marketing engaged with throughout the sales process.

You may have noticed that many of these metrics are dependent on your customer acquisition cost, so that’s the first place you should start in calculating your marketing ROI.

Determining Your Customer Acquisition Cost

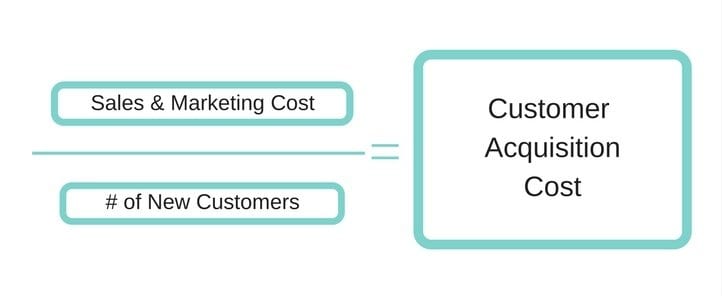

To calculate your CAC, start by taking the total sales and marketing spend for a particular period and divide by the number of new customers for that time. It can be a month, a quarter or a year.

CAC = (total marketing costs + total sales costs) / total customers acquired.

Sales and marketing costs can include program and advertising spend, salaries, commissions and bonuses, and even any overhead for that specific period.

So for example, if your sales and marketing costs for the year are $300,000, and you gained 30 new customers in the year, your CAC equals $10,000 per customer.

What the Results Mean

Customer acquisition cost is important because it illustrates how much you are spending to get a new customer. The lower the average CAC, the better off you will be.

An increase to your CAC means that you’re spending comparatively more for each new customer, which can be a big red flag to how efficient, or inefficient, your sales and marketing are.

While customer acquisition cost is an essential component of calculating your marketing ROI, you will need to use it in conjunction with other marketing metrics to get a full picture of how lucrative your marketing efforts are. Want to learn more? Reach out to HeadsUp today for a free, personalized marketing assessment!