Understanding what you’re doing right – and wrong – in terms of customer retention is a fundamental part of growing your business.

Understanding what you’re doing right – and wrong – in terms of customer retention is a fundamental part of growing your business.

One of the critical factors in a company’s customer retention strategy involves keeping track of customer lifetime value. This metric, also known as CLV, is essentially a projection of total expected revenue from a customer relationship.

Why Customer Lifetime Value is Important

CLV is a useful customer retention metric because it provides clarity regarding the sustainability of your business model and where to allocate your resources.

When you know the total value a customer brings to your bottom line, you are able to make more informed decisions in terms of what to invest in retention and acquisition.

How to Calculate Customer Lifetime Value

To begin measuring CLV, keep your approach as straightforward as possible.

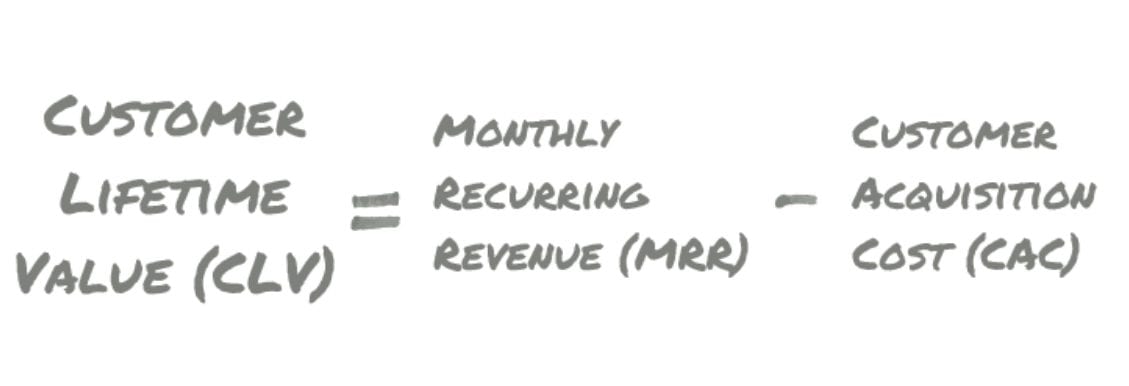

Using the above formula as a guide, you’ll want to take your monthly recurring revenue (MRR) from a single customer and subtract what was spent on acquiring that customer (CAC).

The Ultimate CAC Guide: Use our in-depth analysis to calculate your company’s CAC.

There are plenty of variables involved when it comes to estimating CLV, so it’s important to start with a simple measurement and build from there.

Improving Your Customer Lifetime Value Metric

One of the best ways to increase the CLV for a company is to improve the value a customer receives.

In their ROI of Customer Experience 2018 report, Temkin Group found loyal customers are 7X more likely to try a new offering, 5X more likely to repurchase, and 4X more likely to refer. It’s no surprise that customer experience has a heavy hand in your CLV and retention rate.

Providing outstanding customer service shouldn’t only be about increasing CLV. If you make customer happiness a goal, go above and beyond to meet their needs, and continue to repeat the process with each interaction, loyalty and additional spending are bound to occur.